Link: Apply for the IHG One Rewards Premier Business Credit Card

Hotel credit cards are incredibly underrated. Even if you don’t spend much money on them, they can offer huge perks, including elite status and free night certificates. When you combine these two factors, a lot of these cards offer outsized value.

In this post, I wanted to look at the IHG One Rewards Premier Business Credit Card, which was introduced in 2022. This is an awesome card, nearly identical to IHG’s personal premium card, the IHG One Rewards Premier Credit Card. I’d consider that to be a good thing, since there can be value in holding onto both cards.

In this post:

IHG Rewards Premier Business Card Basics For March 2024

The IHG Premier Business Credit Card is the only Chase and IHG co-branded business credit card. Even if you don’t plan on putting much spending on the card, this card can be worth having for the anniversary free night certificate, fourth night free on award redemptions, elite status, and much more.

For those unfamiliar with IHG (InterContinental Hotels Group), the group owns InterContinental, Six Senses, Regent, Holiday Inn, Crowne Plaza, Hotel Indigo, and more. Let’s take a closer look at what you need to know about this business card.

Welcome Bonus Of 140,000 IHG Points

The IHG Premier Business Card is offering a welcome bonus of 140,000 IHG points after spending $3,000 within the first three months. Personally, I value IHG points at 0.5 cents each, so to me, that bonus is worth $700.

IHG Business Credit Card Eligibility

The welcome bonus on the IHG Premier Business Card isn’t available to those who currently have this exact card, or those who have received a new cardmember bonus on this card in the past 24 months. However, you are eligible for the card if you have either of the personal IHG cards, including the IHG One Rewards Premier Credit Card (review) or IHG One Rewards Traveler Credit Card (review).

$99 Annual Fee

The IHG Premier Business Card has a $99 annual fee. You can add additional cardmembers to your business account at no extra cost. As I’ll explain below, the annual fee is well worth it even if you don’t spend money on the card, since you get an anniversary free night certificate.

Earning Points With The IHG Premier Business Card

The IHG Premier Business Credit Card has a pretty well-rounded rewards structure, and it could very well be worth spending money on the card. That’s especially true when you consider the new spending threshold bonuses.

10x Points At IHG Properties

If you have the IHG Premier Business Card then you can earn a total of 26x IHG points per dollar spent at IHG properties. However, in reality, not all of those points are coming from the credit card as such. Here’s how this breaks down:

- You earn 10x points from IHG for being an IHG program member

- You earn 6x points from IHG with Platinum status, which is a benefit of this card

- You earn 10x points for paying with your IHG Premier Business Card

5x Points On Travel, Gas Stations, Dining, & More

The IHG Premier Business Card offers 5x points in a variety of spending categories, including:

- 5x points on travel, including hotels

- 5x points at gas stations

- 5x points on dining

- 5x points on social media and service engine advertising

- 5x points at office supply stores

There are no caps on any of those bonus categories, so you can earn 5x points on unlimited spending in any of those categories. Based on my valuation of IHG points, that’s like a ~2.5% return on that spending. In and of itself that’s not so amazing, but there are further incentives to spend money on the card.

3x Points On Other Purchases

For categories in which you can’t earn 5-10x points, the IHG Premier Business Card offers 3x points per dollar spent. There are potentially still better cards for everyday spending, though there are some significant incentives to spend money on the card, which I’ll cover below.

No Foreign Transaction Fees

The IHG Premier Business Credit Card has no foreign transaction fees, so it’s a good card for purchases abroad. That’s especially true when staying at IHG properties abroad, as well as for dining and commuting outside the United States.

$100 Statement Credit & 10,000 Bonus Points With Spending

As a further incentive to spend money on the card, the IHG Premier Business Card offers a $100 statement credit plus 10,000 bonus points when you spend $20,000 on the card in a calendar year, plus make one additional purchase.

As I mentioned above, I value IHG points at 0.5 cents each, so between the statement credit and points, that’s like $150 of additional value, making it an incremental 0.75% return on $20,000 worth of spending. When you stack it with the card’s other perks, that could add up.

IHG Diamond Status With Spending

The IHG Premier Business Card offers IHG Diamond status if you spend $40,000 or more on the card in a calendar year. This is IHG’s top tier elite status, which offers perks like complimentary breakfast, room upgrades, late check-out, and more.

With the Milestone Rewards program (which you can unlock based on how many elite nights you earn with IHG per year), you can receive benefits like confirmed suite upgrades, club lounge access, food & beverage credits, and more.

A Second IHG Anniversary Free Night With Spending

In addition to the anniversary free night award that you get just for having the card (which I’ll cover below), you can earn a second free night award annually when you spend $60,000 on the card in a calendar year. The free night award can be used at a property costing up to 40,000 points, though you can use additional points to top off the award and redeem at more expensive properties.

IHG Premier Business Credit Card Benefits

What makes the IHG Premier Business Credit Card exceptional is the benefits and perks that it offers, which in my opinion more than offset the annual fee on the card. Let’s take a look at some of those perks.

IHG Anniversary Free Night

Every year on your account anniversary you get a free night certificate, valid at any property costing up to 40,000 points per night. This doesn’t require any spending, though as noted above, you can earn a second free night award by spending $60,000 on the card in a calendar year.

Best of all, you can use points to top off your award and redeem at a more expensive property. In other words, you could book a hotel costing 60,000 points per night by using the certificate and redeeming an additional 20,000 points.

This free night certificate will be issued shortly after your anniversary and is valid for 12 months. I’ve consistently gotten huge value with these certificates, and have been able to redeem them at properties costing $250+ per night. And that’s not even accounting for the ability to top them off and redeem at more expensive properties.

Fourth Night Free On Award Redemptions

Just for having the IHG Premier Business Card you get a fourth night free on award redemptions. When you book four consecutive nights on an award redemption then you only have to redeem points for the first three nights.

This is an awesome perk, since it can be used an unlimited number of times (you can even use it to book multiple rooms at the same hotel). If you usually redeem points for stays in increments of four nights, this is like getting 25% off all your redemptions.

IHG One Rewards Platinum Status

You receive IHG One Rewards Platinum status for as long as you have the IHG Premier Business Card. Among other things, IHG Platinum members receive:

- Complimentary room upgrades, subject to availability

- 60% bonus points

- Late check-out, subject to availability

- Priority check-in

- Complimentary internet

- Welcome amenity

- Access to award sales throughout the year

- Access to the Milestone Rewards program based on how many elite nights are earned, offering perks like confirmed suite upgrades, club lounge access, and more

Up To $50 United TravelBank Cash Per Year

The IHG Premier Business Card offers up to $50 in United TravelBank Cash per year:

- Each calendar year you’ll receive one $25 United TravelBank Cash deposit around January 1, and another around July 1

- Deposits made between January 1 and June 30 expire on July 15, and deposits made between July 1 and December 31 expire on January 15

- You must complete one-time registration to receive this benefit

If you fly United with any frequency, then this is like $50 worth of travel on United per year, which is awesome.

Global Entry, TSA PreCheck, Or NEXUS Credit

The IHG Premier Business Card offers a Global Entry, TSA PreCheck, or NEXUS credit once every four years. Just charge the membership fee of up to $100 to your card, and it will automatically be reimbursed. It doesn’t matter who the fee is being paid for, as long as you charge it to your eligible card.

Is The IHG Premier Business Card Worth It?

If you stay at IHG properties with any frequency, then I think the IHG Premier Business Credit Card is absolutely worth having.

The card’s $99 annual fee is easy to justify based on the perks that it offers. The card offers an anniversary free night certificate, a fourth night free on award redemptions, IHG Platinum status, up to $50 in United credits per year, a Global Entry fee credit, and more.

Admittedly if you have the personal card as well, some of the benefits do overlap. However, I consider the anniversary free night award alone to be worth more than the annual fee, so that’s a reason to pick up this card.

IHG Premier Personal Card Vs. IHG Premier Business Card

The IHG One Rewards Premier Credit Card (review) is the personal version of this card, so how does it compare? The benefits are virtually identical, though I’d say the business version of the card has some potential advantages:

- Both cards offer an anniversary free night certificate, IHG Platinum status, a fourth night free on award redemptions, up to $50 in United TravelBank Cash each year, etc.

- The major differences are that the business card has a few more bonus categories, and offers an additional free night award if you spend $60,000 on the card in a calendar year

Both of these cards are excellent, and personally, I think it’s worth picking both up, so that you can earn two free night awards per year without having to spend anything.

Other Options For Earning IHG Points

If you want to earn IHG points without having an IHG card, keep in mind that IHG is a transfer partner with Chase Ultimate Rewards, so you could transfer points at a 1:1 ratio. For example:

- The Chase Sapphire Reserve® Card (review) offers 3x points on dining and travel

- The Chase Sapphire Preferred® Card (review) offers 3x points on dining, online groceries, and streaming services, and 2x points on travel

- The Ink Business Preferred® Credit Card (review) offers 3x points on the first $150,000 spent annually on travel, shipping purchases, internet, cable and phone services, and advertising purchases made with social media sites and search engines

- The Chase Freedom Unlimited® (review), in conjunction with one of the above cards, earns 3x points on dining and drugstores, and 1.5x points on all purchases

- The Chase Freedom FlexSM (review), in conjunction with one of the above cards, earns 3x points on dining and drugstores, and 5x points in rotating quarterly categories

That being said, in general, I absolutely wouldn’t recommend transferring Chase points to IHG. As I said, I value IHG points at ~0.5 cents each, while you can instead transfer points at the same ratio to programs like World of Hyatt, where I value the points at ~1.5 cents each (three times as much).

Sometimes it can make sense to buy IHG points when the program has a sale. IHG sometimes sells points with a 100% bonus, which brings down the cost per purchased point to 0.5 cents. When you stack that with the fourth night free offered by this card and the Platinum perks you’ll receive, that could be well worth it.

Bottom Line

The IHG Premier Business Credit Card is a product that I highly recommend getting. The card’s $99 annual fee is really easy to justify, thanks to the anniversary free night award, up to $50 in United credits, IHG Platinum status, and much more.

This free night certificate is the single biggest benefit of the card, and consistently offers outsized value. Best of all, you can top off the award to redeem at a more expensive hotel.

I know some people are opposed to having a lot of credit cards, but often it can make sense to have some cards just for the perks they offer, even if you don’t necessarily plan on spending much money on the card. This is one of those cards.

If you want to learn more about the IHG Premier Business Card or apply, follow this link.

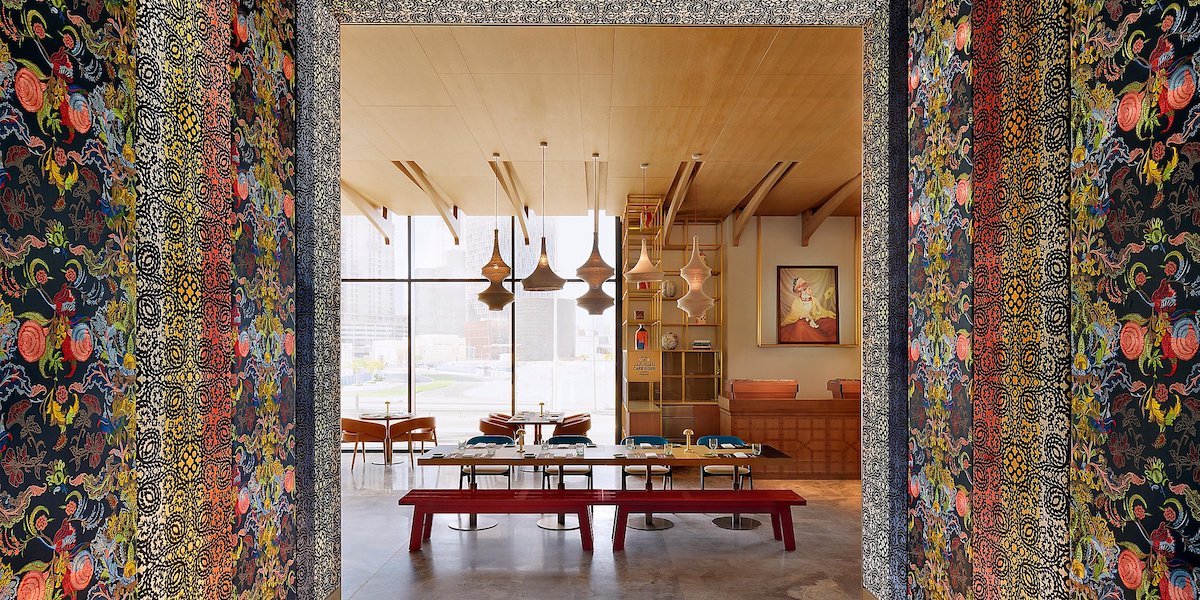

@Ben - is the banner photo from the (former) Kimpton Born in Denver? It is technically no longer part of IHG - as it is the Limelight hotel. I know this because I stayed there two weeks ago :-D