Link: Apply now for the IHG One Rewards Premier Credit Card

Chase and IHG have a co-brand card portfolio, which includes three credit cards:

- There’s the IHG One Rewards Premier Credit Card (review), which is the premium co-brand personal card

- There’s the IHG One Rewards Traveler Credit Card (review), which is the no annual fee personal card

- There’s the IHG One Rewards Premier Business Credit Card (review), which is the co-brand business card

The IHG Premier Card and IHG Premier Business Card offer some fantastic perks that should more than justify the annual fee for frequent travelers, even if you’re not an IHG loyalist. However, there are some conditions associated with these perks, so in this post I wanted to dig a bit deeper into how they work.

In this post:

IHG Premier Card perks & benefits

To first cover the current welcome offers on these two cards:

- For applications through April 3, 2024, the IHG Premier Card has a limited-time welcome offer of 165,000 IHG points after spending $3,000 within the first three months

- The IHG Premier Business Card has a welcome offer of 140,000 IHG points after spending $3,000 within the first three months

It’s not just the bonuses that should make you interested in these cards, though. Both the IHG Premier Card and IHG Premier Business Card offer some unique perks, including:

- A free night certificate on your account anniversary every year, valid at any property that retails for up to 40,000 IHG points per night; you’re even able to top off your certificate with points to book a more expensive property (in other words, a property costing 60,000 points could be booked using a free night certificate plus 20,000 points)

- A fourth night free on award bookings; when you redeem points for a consecutive four night stay, you only have to redeem points for the cost of the first three nights

- A $50 United TravelBank credit every calendar year

- 20% off when you purchase IHG One Rewards points

- IHG One Rewards Platinum status for as long as you have the card

- A TSA PreCheck or Global Entry fee credit every four years

Those are some awesome perks, and I’ve received a lot of questions about how certain benefits on the cards work. In this post, I wanted to take a closer look at some of the details of these benefits.

How does the fourth night free benefit work?

One of the best perks of the IHG Premier Card and IHG Premier Business Card is that they offer a fourth night free on award redemptions. There has been some confusion regarding how this benefit works, and specifically at what point the cost of the fourth night is reimbursed.

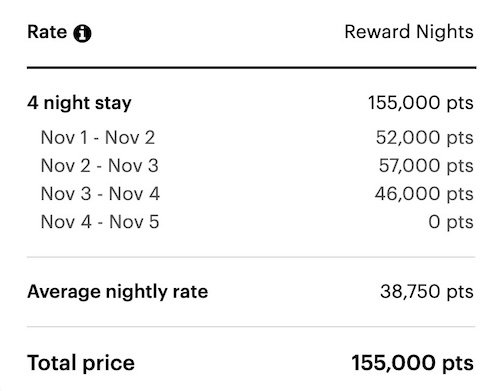

With this benefit, the fourth night’s cost is deducted when you make your award booking. Once you have the card and go to IHG’s website to make an award booking for four nights, you should automatically see the price adjusted. When you first see the award cost you’ll see a price with a line through it, which is the original price, and then underneath that is the discounted price factoring in the fourth night free.

To give an example, the Kimpton Fitzroy London London Park Lane may cost an average of around 52,000 points per night (IHG has dynamic award pricing, so the rate can vary each night). Yet with a fourth night free the price is lowered to 38,750 points, with the total cost being 155,000 points.

This is great, since it means you only need enough points for the cost of three nights to make the booking. If this isn’t displaying correctly for you, it’s probably because you haven’t had the card for long enough. It can take a few days for this benefit to kick in.

You can use this benefit an unlimited number of times, and can even use it for back-to-back stays (in other words, you can book eight consecutive nights at one hotel and get two nights free), or for multiple rooms at a hotel over the same nights. It’s also valid at Six Senses properties, which are being integrated into the IHG One Rewards program.

You do need to stay four consecutive nights at one hotel while redeeming points to use this, meaning you can’t stay two nights at one hotel and two nights at another hotel, and then get one of those nights free.

Furthermore, all four nights need to be booked as a single points reservation. This means you couldn’t book one night with a free night certificate and then three nights with points, and get that third night of the points reservation free.

Can you earn multiple anniversary free night certificates?

Yep, you absolutely can earn multiple free night certificates each year. For example, both the IHG Premier Card and IHG Premier Business Card offer free night certificates on the account anniversary every year. It’s possible to have both of these cards, in which case you could even use them for back-to-back stays.

Those who have the legacy IHG Select Card (no longer open to new applicants) can also potentially earn a further free night certificate, so there are lots of opportunities here.

Can the IHG 20% points discount be stacked with a sale?

The IHG Premier Card and IHG Premier Business Card offer a 20% discount when you purchase points. Unfortunately, this isn’t valid when IHG is offering a discount on purchased points, which is when I would generally consider buying points.

There’s no reason to buy IHG points for 20% off when IHG otherwise sometimes offers 75-100% bonuses on purchased points. When the discount is available, you’ll see that it’s automatically applied at the time you purchase points. This is a benefit that’s almost never worth it, in my opinion.

How does the TSA PreCheck or Global Entry credit work?

The IHG Premier Card and IHG Premier Business Card offer a TSA PreCheck, Global Entry, or NEXUS fee credit once every four years. You can choose either one (in general Global Entry or NEXUS are your best bet, since both come with TSA PreCheck), and then the statement credit will automatically post within 24 hours of the eligible purchase appearing on your account.

Note that all that matters is that the fee is charged to your card, so if you already have a Global Entry or TSA PreCheck membership, you can use this for a friend or family member.

When does IHG Platinum status post to your account?

Just for having the IHG Premier Card or IHG Premier Business Card, you get IHG One Rewards Platinum status for as long as you’re a cardmember. This will post to your account automatically, and that’s determined based on having the correct IHG One Rewards number linked to your account.

While the terms state that the status will post within six to eight weeks, in practice, it usually posts much faster than that.

How does the $50 in United TravelBank Cash work?

Both the IHG Premier Card and IHG Premier Business Card offer up to $50 in United TravelBank Cash every calendar year. This is pretty straightforward:

- Each calendar year you’ll receive one $25 United TravelBank Cash deposit around January 1, and another around July 1

- Deposits made between January 1 and June 30 expire on July 15, and deposits made between July 1 and December 31 expire on January 15

- You must complete one-time registration to receive this benefit

This is essentially the equivalent of $50 worth of travel on United annually, assuming you fly the airline with any frequency.

Bottom line

The IHG Premier Card and IHG Premier Business Card are all-around worthwhile cards. Between the Platinum status, fourth night free on awards, an annual free night, and $50 in United TravelBank cash, I’d say these cards are well worth getting if you’re eligible, even if you’re not otherwise an IHG loyalist.

What has your experience been with the perks on the IHG Premier Card?

I linked my IHG and United accounts in December, 2022, and quickly received $25 in my United Travel Bank. Since then, I have received nothing. During January 2023, July 2023, and January 2024 I spoke with numerous IHG, Chase, and United phone reps, all of which told me to contact the other two.

I am on the phone right now with the United Mileage Plus Service Center and have spoken with two reps, waiting...

I linked my IHG and United accounts in December, 2022, and quickly received $25 in my United Travel Bank. Since then, I have received nothing. During January 2023, July 2023, and January 2024 I spoke with numerous IHG, Chase, and United phone reps, all of which told me to contact the other two.

I am on the phone right now with the United Mileage Plus Service Center and have spoken with two reps, waiting for a third. Earlier today an IHG supervisor told me I have to call United to "Register missing travel bank credit". I tried with the first United rep, Carla, but she told me she would transfer me to a supervisor. Instead, she transferred me to web support in Luzon, Philippines. Maybe United hates me because I dropped from 1K to Platinum.