Over the past several years we’ve seen the number of credit cards in the market with no foreign transaction fees increase drastically. This is great news for frequent travelers, and couples nicely with the global acceptance of credit cards increasing as well.

Not only can I now make credit card purchases abroad without incurring foreign transaction fees, but in many cases I can also earn a huge number of bonus points. For example, you can earn bonus points on not just international airfare and hotel purchases, along with things like dining, parking, taxis, public transportation, etc.

While a lot of cards have no foreign transaction fees, that doesn’t actually mean you’re getting the same deal on all cards. The exchange rate can vary based on which card you’re using.

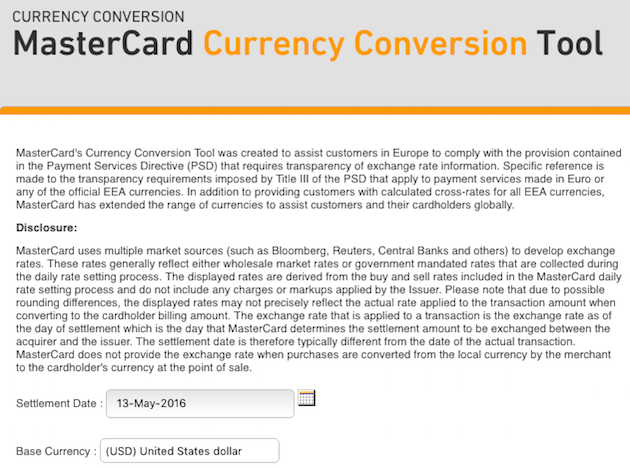

MileValue links to the online tools which allow you to see the daily exchange rates being used by Mastercard and Visa:

This reveals some interesting things:

“No foreign transaction fees” doesn’t always mean you’re getting a fair rate

It’s easy to assume that “no foreign transaction fees” means you’re getting the market rate, but that’s not necessarily true. If you were truly getting the “fair” exchange rate, then the conversion rate would be roughly the same going from Currency A to Currency B as it is going from Currency B to Currency A. But that’s not the case.

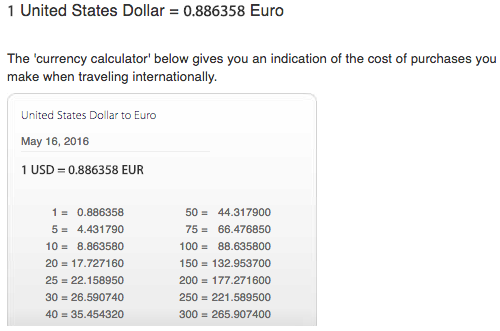

Let’s look at the Visa currency conversion tool, for example. According to it, 1USD converts to 0.886358EUR.

Logically you should be able to divide 1 by 0.886358 to get the conversion rate from EUR to USD. 1/0.886358 is 1.1282USD per EUR. Yet the conversion rate when going back is 1.138186USD per EUR. So that’s a spread of ~0.89%.

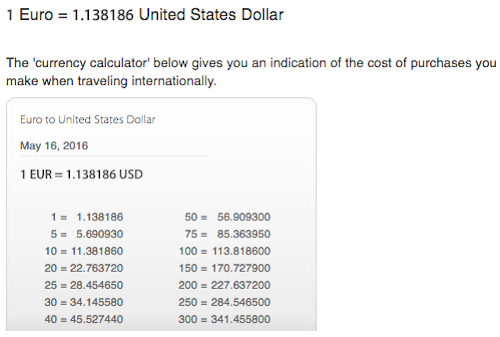

So let’s look at the same for Mastercard. 1USD converts to 0.880592EUR. Logically you should be able to divide 1 by 0.880592 to get the conversion rate from EUR to USD. 1/0.880592 is 1.135599USD per EUR. Yet the conversion rate when going back is 1.135301USD per EUR. That’s a spread of only ~0.02%, which is much better.

As you can see, MasterCard’s conversion rate is much fairer, in this instance.

Does Mastercard really have better exchange rates?

I figured I’d look at the exchange rates for some random currencies to see whether Mastercard really has better exchange rates than Visa. Here’s a table with a few examples:

Value per USD | MasterCard | Visa |

|---|---|---|

AUD | 1.37855 | 1.36421 |

EUR | 0.880592 | 0.87859 |

GBP | 0.693193 | 0.69154 |

HKD | 7.7633 | 7.7592 |

JPY | 108.5 | 108.5069 |

RUB | 64.7 | 64.6 |

SGD | 1.3755 | 1.36944 |

ZAR | 15.035 | 14.9941 |

As you can see, Mastercard’s exchange rate is better in all instances, except with the Japanese Yen, where Visa is slightly better.

Rumor has it that the reason for this discrepancy is as follows:

- Visa guarantees the exchange rate the day you make the purchase, but has a built in cushion since the transaction typically only posts a couple of days later, so exchange rates could change, meaning there’s some risk for Visa

- Mastercard charges the exchange rate the day the transaction posts (often a couple of days after the transaction), so since they’re charging whatever the rate is, the cushion is much smaller

Bottom line

In the past I’ve always decided which card to use abroad based on which offered the best rewards. I never really considered that the exchange rates can vary pretty significantly among cards without foreign transaction fees.

While there are some instances where Visa may end up being cheaper due to a change in conversion rates, from hereon out I’ll be using Mastercards for all my international purchases. That works out great, since there are several rewarding points cards that run on the Mastercard network.

- Earn 3x Points on Airfare

- Earn 3x Points on Hotels

- Earn 3x Points at Restaurants

- $95

- Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases

- Admirals Club Membership

- No Foreign Transaction Fees

- $595

- Earn 2x AAdvantage miles on eligible American Airlines purchases

- First Checked Bag Free

- American Airlines Companion Certificate

- $99, waived for first 12 months

Have you ever considered exchange rates used by different cards when deciding which card to use abroad?

Totally correct, backed up by https://www.moneyhub.co.nz/mastercard-vs-visa.html - difference on average around 1%

I just used my Capital One MasterCard for the first time in China. My copy of the receipt had an option to tick to choose USD or RMB, but there was a note that no signature is required because the amount is less than 1,000 RMB.

I asked the merchant to make sure the charge was in RMB but they said they have no control over this.

I suspect this is a case of hard coded DCC. I will make a dispute if the posted charge is the USD amount indicated on the receipt.

Thank you for this informative post. However, Mastercard's rates--which they say they derive from Bloomberg, Reuters, etc--are almost always higher than their sources' rates. They post the previous day's rates, and then "explain" in twisted bank language that maybe this is or isn't the rate that day. This is bs, people. And then most banks tack on 3 percent over that horrid rate--in fact my bank tack on 3.4 percent, which isn't legal. I'm making...

Thank you for this informative post. However, Mastercard's rates--which they say they derive from Bloomberg, Reuters, etc--are almost always higher than their sources' rates. They post the previous day's rates, and then "explain" in twisted bank language that maybe this is or isn't the rate that day. This is bs, people. And then most banks tack on 3 percent over that horrid rate--in fact my bank tack on 3.4 percent, which isn't legal. I'm making complaints about this everywhere--including to the relevant federal agencies. Banks need to be TRANSPARENT about the rate THAT DAY. Why is this a guessing game. And, trust me, look at the rates--tack on 3 percent--and still the banks/credit cards are probably charging more. Be aware people. Start questioning your bank. And MC isn't doing us a favor with their rates--they take the highest or near highest from the day before. DEMAND CLARITY AND TRANSPARENCY. Well, I am.

@swc

> I’ve complained to Citi, but they say there’s no mechanism to dispute DCC.

Very untrue. If I authorized XXX 100 (where XXX is the local currency) and the charge comes through as USD 150 through the unauthorised use of DCC I routinely dispute the entire amount, which I never authorized, inviting the merchant to repost the authorized XXX 100. It works every time, with the benefit that not always the merchant reports the...

@swc

> I’ve complained to Citi, but they say there’s no mechanism to dispute DCC.

Very untrue. If I authorized XXX 100 (where XXX is the local currency) and the charge comes through as USD 150 through the unauthorised use of DCC I routinely dispute the entire amount, which I never authorized, inviting the merchant to repost the authorized XXX 100. It works every time, with the benefit that not always the merchant reports the charge so I actually "make" money on the deal.

I suggest everyone does the same to contact this fraud.

I've also learned to be very explicit whenever I am offered a receipt with the two currencies: not only I select the local currency, but I cross off the USD amount, cross off all the preprinted DCC language, and write "No DCC" on top of the signature. This has reduced the number of fraud significantly, as I think the merchant is inclined to think twice before putting it through as DCC.

@Michael C: Technically sound advise. Practically can be tough when you are away on long biz trips and when FOREX rates are updated regularly (in some cases every 12 hours by some banks). Practically, I have never seen much difference in my expenditures regardless of the card used so it seems like a task not worth too much spent time on.

@Jacky, @Jared

That's why you should call your bank and check your particular credit card. Fortunately, all of my banks use the VISA / MC exchange rate. Specifically, the cards I have are through Citi, Chase, and Comenity.

I live in the US and all of my cards are through US banks. But that's a good thing to keep in mind if you are using an Asian bank. Another reason to call and check.

@Michael C: There are several major banks across Asia which add surcharges on top of the Visa/MC rates for Visa/MC cards respectively, but they do not designate these as "international surcharge" fees. Instead, these are publicized as the non-commodity market FOREX rates. Unsurprisingly, some of these banks are across PRC and govt. banks across South and East Asia.

@Michael C

That is not true, sometimes bank does use their own exchange rate.

@jacky, @ jared

Before travelling abroad, I always call the bank that issues the card that I plan to use, and ask them about their exchange rate. Every single time, I have been told they use the VISA or MC exchange rate. I have never been told they use their own rate. However, when using ATM's abroad, the banks use their own exchange rate.

Unless you plan to spend a lot of money, the...

@jacky, @ jared

Before travelling abroad, I always call the bank that issues the card that I plan to use, and ask them about their exchange rate. Every single time, I have been told they use the VISA or MC exchange rate. I have never been told they use their own rate. However, when using ATM's abroad, the banks use their own exchange rate.

Unless you plan to spend a lot of money, the difference between VISA and MC is quite small. For example if you look at the EUR, the difference is $2 for every $1000 spent. For small purchases, the difference is not enough for me to choose VISA over MC, if my preferred card is a VISA.

Decisions decisions. Citibank is clearly offering a better card, but then I have to give my money to one of the most corrupt banks in the world. I think I'll hold off and find another solution for now, even if it means I have to pay a little more.

More corrupt than Jamie at Chase? The banking industry is setting new standards all the time!

In my experience, Amex is cheaper than both mc and visa.

and of course you wouldn't want to willingly pay a fee to visa to insure against currency risk. do you have a crystal ball?

DCC = Dynamic Currency Conversion, eg the option to pay in your home currency at the terminal, usually at an unfavorable rate. Always good to refuse, but some terminals in China do not allow you to do so. In which case, cancel the transaction and get them to take AMEX instead.

Put me down as another who has shifted their spend from Sapphire Preferred to Citi MasterCard, because every time I checked the rates, I...

DCC = Dynamic Currency Conversion, eg the option to pay in your home currency at the terminal, usually at an unfavorable rate. Always good to refuse, but some terminals in China do not allow you to do so. In which case, cancel the transaction and get them to take AMEX instead.

Put me down as another who has shifted their spend from Sapphire Preferred to Citi MasterCard, because every time I checked the rates, I got a considerably better exchange rate on MasterCard (0.5 - 1%).

Thanks for defining DCC. I knew to NOT pay in home currency but I didn't know that's what it's called. Pretty dynamic alright...

This is a great post, but I'd like to see a more thorough analysis of the pros and cons of Chase's Sapphire vs. one of the Citibank MCs. In spite of the potential for a currency to wildly fluctuate, it seems to me that on a day-to-day basis, it would be better to use the MC than a Visa IF everything else is equal: the point value, the number of points/miles earned, and any other...

This is a great post, but I'd like to see a more thorough analysis of the pros and cons of Chase's Sapphire vs. one of the Citibank MCs. In spite of the potential for a currency to wildly fluctuate, it seems to me that on a day-to-day basis, it would be better to use the MC than a Visa IF everything else is equal: the point value, the number of points/miles earned, and any other fees and charges. Does anyone have such an analysis? And, what's a DCC trap? How do I know one if there is one, and what can I do? I spend much of the time in Spain it seems that Amex, for the most part, is out of the question. Even though the Platinum has no FTF, so few places accept here that I have stopped carrying it.I was able to use it once in the Netherlands. does this correlate with others' experiences? Thanks; this is very interesting and useful.

@nws @Jacky

If you have an Amex that has 0% fees, then it makes a lot of sense to use in it China.

I've never had a problem getting partial refunds from Chase when filing a dispute, but it's still a pain. That's odd that Citi won't let you dispute them.

@jared

banks follow the VISA/MC rates when using the VISA/MC networks. Some situations where they don't follow the rates, as they don't use those network:

When you use your Citibank or HSBC card at a foreign Citibank or HSBC ATM. That's why I avoid using my HSBC card at a HSBC ATM, as I get a much better rate if using another ATM, even if I have to pay a small fixed fee.

The banks do not need to adhere to Visa's or MC's rates. In my experience very few banks follow the recommended forex rates. The rates between the two CC providers are continually changing so this is not a conclusive nor statistically significant comparison.

The data is not enough to make any conclusion. Lucky already stated that Mastercard rates post a few days later. So if USD strengthen during those days then it makes sense that all Mastercard rates are better than VISA's. Because of the two different ways of setting exchange rate you would have to compare the rates during a longer period of time, say a month before you can draw any conclusion.

Yes as Jacky said - I refuse to use my Citi MasterCard in China anymore - too many DCC traps!! Even if you explicitly select to be charged in local currency on the receipt slip and tell the cashier, the Chinese processing bank applies DCC with a huge built-in markup. I've complained to Citi, but they say there's no mechanism to dispute DCC. So I just refuse to use the card in China.

According to Gary a few months ago, AMEX and Visa were about the same:

http://viewfromthewing.boardingarea.com/2016/02/23/44961/

Some shops in Japan offer a 5% discount to those paying with a Visa credit card issued outside of Japan. MasterCard has a presence in Japan, but it seems to be much smaller than Visa or JCB.

Something to think about when deciding which cards to use!

And how much did MasterCard pay for this post?

Your analysis is not comprehensive.

1. Bank does not have to use Visa/MasterCard published exchange rate. They can even use their own exchange rate in some cases. This happened to my Chase Sapphire in the past.

2. There are many DCC traps. When merchant does the conversion for you, the fee is usually very high. What makes it worse is, on some sales terminals, DCC is hardcoded. It kicks in automatically when it detects a...

Your analysis is not comprehensive.

1. Bank does not have to use Visa/MasterCard published exchange rate. They can even use their own exchange rate in some cases. This happened to my Chase Sapphire in the past.

2. There are many DCC traps. When merchant does the conversion for you, the fee is usually very high. What makes it worse is, on some sales terminals, DCC is hardcoded. It kicks in automatically when it detects a foreign credit card. For example, in China, most Bank of China's POS are hardcoded DCC. Even if you tell the merchant to charge in CNY, the POS will still use DCC. You could lose more money on this than FX fee.

3. On the other hand, AMEX does not support DCC, which is a good thing sometimes. You save money.

I agree with Ken - Sapphire has become much less attractive since the introduction of Citi Premier. I would also love to know what exactly is the advantage of using Sapphire over Citi Premier?

But depending which way the currency moves and the size of the transaction you might be better with the Visa vs Mastercard setup! Sadly Amex always sucks as for those of us outside the USA we're stuck with a 3% forex fee!

Aviator Red MasterCard is also Chip and Pin.

Thanks for posting this, this is great information - particularly now as I have been using my Amex less and less.

I totally agree with the post, provided the currency tools are trustable.

In my inventory, however, a VISA gives me UA miles 1% higher so I prefer this.

AmEx sucks anyway.

It's not as clear cut as you make it seem- and your post fully spells out the reason why. Using visa you are effectively paying visa a fee to take the FX risk for you until the transaction closes, while with a MC you take that risk yourself. If you look at the exchange rate of a volatile currency (these days what currency isn't) when you decide to buy something, you could find it has...

It's not as clear cut as you make it seem- and your post fully spells out the reason why. Using visa you are effectively paying visa a fee to take the FX risk for you until the transaction closes, while with a MC you take that risk yourself. If you look at the exchange rate of a volatile currency (these days what currency isn't) when you decide to buy something, you could find it has moved against you and you end up paying more in your home currency than you thought by the time the transaction posts a few days later. With visa you aren't taking that risk. Is that worth 43 bps? Maybe not, but for some, particularly using volatile currencies or making large purchases, it might be.

Now that is providing value!!!

Thank you for that awesome post

Thank you for this very informative post. I had never even considered this!

What about Amex?

I agree with Lucky on this one. I saw the same thing when my wife went on a shopping binge in Paris last year. My MC had a better exchange rate every time

I just got back from Peru and several restaurants and stores didn't accept MC, only Visa. I've never experienced this in anyplace else that I've traveled. I read there were some advantages to MC so used it everywhere possible and used the CSP in the few cases where MC wasn't accepted.

Yes actually another reason why I switched to citi for all of my international travel. Didn't know Japan was an outlier so I will switch when I go to Japan but either way it's almost impossible to use cc in Japan. Sapphire has become much less attractive since the introduction of citi premier. I might even cancel it to save my annual fee. Since citi added protections for award tickets what's the advantage of using sapphire?

@Lucky would clearly like to know IS THIS A PAID POST?

Great post!

I like both comparisons, but they don't quite hang together. The actual difference doesn't match the spread (actually doesn't match 1/2 the spread ) it's smaller.

Nonetheless, the advantage of MC is clear. And I forgot Premier had the best bonus, I was about to cancel (I also have Prestige), but triple on all travel is cool; almost 5% rebate when you have both. As they offered me a retention bonus that will...

Great post!

I like both comparisons, but they don't quite hang together. The actual difference doesn't match the spread (actually doesn't match 1/2 the spread ) it's smaller.

Nonetheless, the advantage of MC is clear. And I forgot Premier had the best bonus, I was about to cancel (I also have Prestige), but triple on all travel is cool; almost 5% rebate when you have both. As they offered me a retention bonus that will cover the annual fee provided I spend $1k:month for 3 months, and I leave Saturday for Europe, you could not have been more timely from my perspective.

@Lucky- is there a fault in the conversion rate because it was stated above that the conversion rate for VISA from USD to EUR is 0.886358 but the table shows 0.87859

I think you answered something I have been thinking about. Have a big cruise coming up in a big suite - lots of dollars.I have been trying to decide which credit card to use to pay. It's on Norwegian. Seems you are indicating that the Citi Premier is the best bet as I would get 3 points per dollar - right?

Thanks.

What about AmEx?