Rental car coverage is one of the most valuable perks of premium credit cards. In this post I wanted to take a look at the basics of how that works, and then cover some of the best credit cards to use when renting cars.

In this post:

How does credit card rental car coverage work?

Most of us rent cars once in a while, and when we do, it can be tough to decide what level of coverage to get. Fortunately nowadays many premium credit cards offer a collision damage waiver (CDW) benefit, which sure will come in handy if your rental car experience doesn’t go as planned.

Before I share the best cards for rental car coverage, I wanted to discuss the basics of how this coverage works.

Primary coverage vs. secondary coverage

You’ll notice that some credit cards offer primary rental car coverage, while others offer secondary coverage. What’s the difference?

- Primary coverage is when the policy applies regardless of what your existing insurance situation is; in other words, if you get in an accident, you could file a claim through your credit card benefit before you have to go through your personal insurance

- Secondary coverage is when your policy is supplemental to any existing insurance benefit you have; in other words, you’d have to go through your personal insurance first, and that could cause your insurance premium to go up

Whenever possible, you’ll want to use a card with primary rental car coverage. It’s also worth noting that some credit cards offer primary rental car coverage abroad, while they only offer secondary coverage in the United States. The logic is that many people have an insurance policy in the United States, which doesn’t cover them abroad.

Collision coverage vs. liability coverage

One very important thing to understand is that a credit card collision damage waiver (CDW) benefit isn’t the same as full liability coverage. Generally speaking these policies cover the damage to your own rental car. However, they generally don’t cover damage to other vehicles or to personal property, and also don’t cover injuries.

So don’t expect that just because you paid for your rental with a credit card that you won’t be on the hook if you cause an accident that damages another car, and potentially injures you or someone else.

Keep an eye out for coverage exclusions

There are potentially big implications for rental car coverage, so always make sure you read the benefits guide carefully, and look out for any exclusions:

- You generally need to pay for your rental with your card in order to get coverage

- Some plans exclude coverage in certain countries

- Most plans exclude certain types of cars, either based on the price or size

- Most plans have limits on how long you can rent for while being covered

- Always be familiar with the process for filing a claim, including the documentation requirements (for example, in some cases you’ll need a police report, you need to file your claim within a certain timeframe, etc.)

This post is intended to give you a general idea of the best credit card policies available, though is no substitute for reading the terms & conditions for your individual credit card policy.

Best personal cards for rental car coverage March 2024

With the above out of the way, let’s take a look at the best personal credit cards for rental car coverage. To me the best coverage would be a policy that gives you a primary CDW benefit globally, and I’ll also note how many rewards points you earn per dollar spent (and my valuation of those points), since that should be factored in as well. After all, you want to maximize your return on spending while also maximizing your coverage.

1. Chase Sapphire Reserve® Card

Reward for rental car spending: 3x Chase Ultimate Rewards points (which I value at 5.1%)

Card annual fee: $550

Other things to be aware of: The Chase Sapphire Reserve offers primary rental car coverage globally with no foreign transaction fees and limited exclusions, all while maximizing the points you earn

Read a review of the Chase Sapphire Reserve, apply for the Chase Sapphire Reserve.

2. Chase Sapphire Preferred® Card

Reward for rental car spending: 2x Chase Ultimate Rewards points (which I value at 3.4%)

Card annual fee: $95

Other things to be aware of: The Chase Sapphire Preferred offers primary rental car coverage globally with no foreign transaction fees and limited exclusions, all while earning you bonus points

Read a review of the Chase Sapphire Preferred, apply for the Chase Sapphire Preferred.

3. Capital One Venture X Rewards Credit Card

Reward for rental car spending: 2x Capital One miles (which I value at 3.4%)

Card annual fee: $395

Other things to be aware of: Review the benefits guide for full details.

Read a review of the Capital One Venture X, apply for the Capital One Venture X (Rates & Fees).

4. United Quest℠ Card

Reward for rental car spending: 2x United MileagePlus miles (which I value at 2.8%)

Card annual fee: $250

Other things to be aware of: The United Quest Card offers primary rental car coverage globally with no foreign transaction fees and limited exclusions, making it one of the best airline cards for renting cars

Read a review of the United Quest, apply for the United Quest.

5. Capital One Venture Rewards Credit Card

Reward for rental car spending: 2x Capital One miles (which I value at 3.4%)

Card annual fee: $95

Other things to be aware of: Review the benefits guide for full details.

Read a review of the Capital One Venture, apply for the Capital One Venture (Rates & Fees).

Best business cards for rental car coverage March 2024

Now let’s take a look at the best business credit cards for rental car coverage. Once again, I’m focused on cards that offer the best coverage while also offering the most rewards. I want to emphasize for business cards, primary coverage generally only applies when renting for business purposes (in some cases it’ll be secondary for personal rentals, while in other cases it won’t be).

1. Ink Business Preferred® Credit Card

Reward for rental car spending: Up to 3x Chase Ultimate Rewards points (which I value at 5.1%)

Card annual fee: $95

Other things to be aware of: The Ink Business Preferred offers primary rental car coverage globally with no foreign transaction fees and limited exclusions, all while maximizing the points you earn

Read a review of the Ink Business Preferred, apply for the Ink Business Preferred.

2. Capital One Spark Miles for Business

Reward for rental car spending: 2x Capital One Spark miles (which I value at 3.4%)

Card annual fee: $95, waived the first year

Other things to be aware of: Review the benefits guide for full details.

Read a review of the Capital One Spark Miles for Business, apply for the Capital One Spark Miles for Business (Rates & Fees).

3. Capital One Spark Cash Plus

Reward for rental car spending: 2% cash back

Card annual fee: $150

Other things to be aware of: Review the benefits guide for full details.

Read a review of the Capital One Spark Cash Plus, apply for the Capital One Spark Cash Plus (Rates & Fees).

4. Ink Business Unlimited® Credit Card

Reward for rental car spending: 1.5x Chase Ultimate Rewards points (which I value at 2.55%)

Card annual fee: $0

Other things to be aware of: The Ink Business Unlimited offers primary rental car coverage globally, which is fantastic for a no annual fee card; however, the card does have foreign transaction fees

Read a review of the Ink Business Unlimited, apply for the Ink Business Unlimited.

5. Ink Business Cash® Credit Card

Reward for rental car spending: 1x Chase Ultimate Rewards points (which I value at 1.7%)

Card annual fee: $0

Other things to be aware of: The Ink Business Cash offers primary rental car coverage globally, which is fantastic for a no annual fee card; however, the card does have foreign transaction fees, and doesn’t offer bonus points on these purchases

Read a review of the Ink Business Cash, apply for the Ink Business Cash.

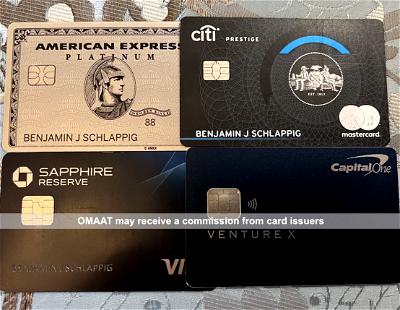

Amex’s premium car rental protection

As you can see above, Chase and Capital One have the best credit cards with rental car coverage. Unfortunately, Citi cards largely don’t offer this kind of coverage anymore.

What about American Express, though, especially given the number of premium cards the issuer has? While Amex cards don’t offer primary rental car coverage as a standard card perk, Amex does have a premium rental car protection program, whereby you can pay a fixed amount per rental to get coverage.

While I’d personally prefer to use a Chase or Capital One card with included coverage, this is worth being aware of if you primarily have Amex cards and want to rent a car.

Bottom line

Credit cards have all kinds of useful benefits, and for those who travel frequently, rental car coverage is essential. As you can see above, Chase and Capital One lead the way when it comes to rental car coverage, while this is an area where Amex and Citi lag.

For personal rentals, it’s hard to beat the Chase Sapphire Reserve or Capital One Venture X, while for business rentals it’s hard to beat the Ink Business Preferred or Capital One Spark Cash Plus.

What’s your go-to card for rental car coverage?

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Capital One Venture X is 10x points when booking rental car through Capital One travel.

The statement about American Express cards and not having primary coverages is not accurate. I have a Delta Gold American Express and it comes with primary coverage with the option if I would like for premium coverage.

Those of us who have been in the miles game for a long time may still have a Diners Club Professional card, the granddaddy of primary coverage cards. Excellent customer service and quick turnaround on claims.

I missed if you distinguished the type of primary coverage. Does it cover both collision damage and liability???

I’ve used the AmEx $25/rental and while Knock in Wood haven’t had an accident. My belief is that with the AmEx Premium coverage I’d pretty much just let AmEx and the rental car co fight it out - especially in Mexico (although I get liability through the required purchase).

I also have a personal liability...

I missed if you distinguished the type of primary coverage. Does it cover both collision damage and liability???

I’ve used the AmEx $25/rental and while Knock in Wood haven’t had an accident. My belief is that with the AmEx Premium coverage I’d pretty much just let AmEx and the rental car co fight it out - especially in Mexico (although I get liability through the required purchase).

I also have a personal liability umbrella policy through State Farm (paid today btw)

One of the top 10 things I learned in Law School - get the insurance ;-)

You should do an honorable mention for other cards that offer primary coverage, which to me is the bigger advantage than rewards when it comes to rental cars. I have the Chase United Explorer card and the Chase United Business card. Yes, I signed up for both for the mileage bonuses but do exclusively use them for car rentals. The primary coverage saves so much grief rather than having to go through your personal insurance...

You should do an honorable mention for other cards that offer primary coverage, which to me is the bigger advantage than rewards when it comes to rental cars. I have the Chase United Explorer card and the Chase United Business card. Yes, I signed up for both for the mileage bonuses but do exclusively use them for car rentals. The primary coverage saves so much grief rather than having to go through your personal insurance first. And the yearly cost is free for the first year and $95 a year thereafter.

I use Amex. It's a $20 per rental charge over the cost of the car. You need to set it up before you rent. Fortunately, I have never had to use it. My usual rental period is about 10 days so it's cheap for what it provides.

I would bet that many of your readers - like me - do not own cars and therefore do not have any car insurance. This makes the primary vs secondary distinction is irrelevant for us. So it would be good to state this up front - for those who don't own a car etc etc.

Just finished working a claim for some minor damage to a rental car. Used my Chase Sapphire Reserve. Very easy online form to update required documents. Ran into one small technicality which resulted in a denial of coverage. However, I spoke with a claims specialist on the phone. I explained the situation and was guided in writing my appeal of the denial. A week later it was approved.

I alway use my Chase Ink Business or my Chase Preferred card and decline the damage coverage. Does anyone know if you can decline the damage coverage so if any accident Chase will cover it but still buy the liability coverage without any issues from Chase?

Don't forget the Ritz Card which deserves at least an honorable mention for primary CDW -- not available for new sign ups, but still available via product change.

I thought World Mastercard covered all this.

What do you think of the new Bilt no-annual-fee card offers primary car insurance. I’m curious: why is this too good to be true?

What do you think of the new Bilt no-annual-fee card offers primary car insurance. I’m curious: why is this too good to be true?

Chase Sapphire has always been my go-to card for rental car insurance for many years, but I recently heard that the new Bilt no-annual-fee card offers primary car insurance. I’m curious: why is this too good to be true?

If you use a Chase card, note that you have to pay AND reserve the rental with the same Chase card. That was my experience when making a claim. I had to show that I reserved with the card and paid with the card in order for them to process the claim.

Venture X doesn’t cover in Ireland, Northern Ireland, Jamaica and Israel.

Good point! (Same policy for the US Bank Altitude Reserve, another Visa Infinite not listed here)

Also, AMEX coverage doesn't include any of those places (it does seem to include Northern Ireland), or even Australia, New Zealand or Italy!

Do "rentals" with car sharing compaines (i.e. Toro) appy to this coverage as well?

Fix this? They cannot be the same 'value'

1. Chase Sapphire Reserve® Card

Reward for rental car spending: 3x Chase Ultimate Rewards points (which I value at 5.1%)

2. Chase Sapphire Preferred® Card

Reward for rental car spending: 2x Chase Ultimate Rewards points (which I value at 5.1%)

Does anyone have any real life experience filing a claim? Hassle? My strategy is to use an AMEX card with the premium rental car protection program and purchase liability coverage at the rental car counter.

AMEX was amazing when my car was damaged.

Thanks for this update. Did you have to get a police report? Take pictures of the damage?

If you need liability coverage & don't already own a car it might be cheaper to buy your own stand-alone annual policy.

I have full coverage automobile insurance, but I prefer to keep my automobile insurer removed from a rental car accident. Thank you for the suggestion.

I used my Ritz Carlton card for a rental and then coverage in October of last year. Side swiped a pole, with about $4000 of total damage (repair, time out of commission, etc.). Did all of the paperwork on line, had two brief phone calls. The insurer sent a check directly to Hertz, no issues. It was great. I know this card is no longer available, but coverage is the same as for the Sapphire...

I used my Ritz Carlton card for a rental and then coverage in October of last year. Side swiped a pole, with about $4000 of total damage (repair, time out of commission, etc.). Did all of the paperwork on line, had two brief phone calls. The insurer sent a check directly to Hertz, no issues. It was great. I know this card is no longer available, but coverage is the same as for the Sapphire Reserve or you can do a product change from one of the other Bonvoy cards. After this experience I will always use CSR or RC cards when renting a vehicle.

I've had two claims with Chase, Both were easy and quick payment.

I filed with Chase recently after a $3,000 ding in Spain. Uploaded documents to the claim portal on Monday, email saying claim approved in full on Wednesday, money in my checking account on Thursday. And I made 3,000 miles out of it.

"While Amex cards don’t offer rental car coverage as a standard card perk."

Correction: While Amex cards don’t offer ***PRIMARY*** rental car coverage as a standard card perk.