The United Kingdom has the world’s highest taxes for airline passengers, known as the Air Passenger Duty (APD). In this post, I wanted to look at how the APD works — what is it, how much does it cost, when does it apply, and are there any tricks to minimizing it? The UK has made changes to the APD as of April 2023, so I wanted to go over what those changes mean for passengers.

In this post:

What is the UK Air Passenger Duty?

The UK’s Air Passenger Duty is a steep tax levied on any flight originating in the UK — this means that if you’re simply transiting the UK between other countries on one ticket then you shouldn’t be on the hook for this. Rather it’s charged based on having a journey originating in the UK (even if it’s the return portion of a ticket), regardless of where you’re connecting.

Suffice to say that the UK APD is controversial:

- It’s a tax against those traveling from the United Kingdom, rather than those who simply connect in the United Kingdom, as the latter group doesn’t have to pay this

- High taxes negatively impact demand for air travel, since it makes flying more expensive; airlines serving the UK have long fought against this tax, since it raises the cost of airline tickets

For some historical context, the UK APD was first introduced in 1994 and was intended to raise money for the government. When it was first introduced the tax was £5 for destinations within Europe, and £10 for destinations outside of Europe (as you’ll see below, it has gone way up).

Over the years the tax has almost been viewed as an environmental tax, intended to encourage other forms of transportation. Then again, those are pretty limited if you’re traveling long haul from the UK. From an environmental standpoint, there are two issues with this:

- It does nothing to encourage airlines to invest in more efficient aircraft, since you’d think that would be a consideration in terms of emissions

- If this is about the environment, you’d think transit passengers would be on the hook for this, since they have an even bigger environmental impact when taking two flights

How much is the UK Air Passenger Duty?

The UK Air Passenger Duty amount is broken down based on the distance you’re flying, and the class of service you’re flying in. There are four different pricing bands, and here’s the pricing as of April 1, 2023:

- For domestic flights (only within England, Scotland, Wales, and Northern Ireland), the APD is £6.50 (~$8) in economy, and £13 (~$16) in a premium cabin

- For international flights of up to 2,000 miles (short haul), the APD is £13 (~$16) in economy, and £26 (~$32) in a premium cabin

- For international flights of 2,001 to 5,500 miles (long haul), the APD is £87 (~$107) in economy, and £191 (~$236) in a premium cabin

- For international flights of more than 5,500 miles (ultra long haul), the APD is £91 (~$112) in economy, and £200 (~$247) in a premium cabin

In addition to seeing some adjustments to the APD amounts, another major change as of April 2023 is that we’ve seen the introduction of a new domestic pricing band, as well as the introduction of a new ultra long haul pricing band.

Now, there are some further details to be aware of:

- For these purposes, a premium cabin would include anything other than economy, so it includes premium economy, business class, and first class

- If you upgrade your seat the higher UK APD applies, which is why many airlines will request a co-pay when upgrading a flight out of the UK (to account for this cost)

- The distance isn’t measured between your origin and destination, but rather between London and the capital city of the country you’re traveling to

- The distance isn’t measured by the distance of your nonstop flight from the UK, but rather by your final destination on your itinerary (assuming continuous travel with no stopovers of more than 24 hours); in other words, the same APD applies whether you fly from London to New York nonstop, or from London to Paris to New York, even though the former itinerary has a much longer nonstop flight out of London

- The UK APD is in addition to any airport taxes and fees, so this isn’t even all you’ll pay in taxes and fees when originating in the UK

When does the UK Air Passenger Duty apply?

Understandably there’s confusion about under what circumstances the UK Air Passenger Duty applies, so let me try to break it down as simply as possible:

- The UK APD applies based on whether you have a flight itinerary originating in the UK; an itinerary is considered to be originating in the UK if you’re on the ground there for more than 24 hours

- The UK APD doesn’t apply for any flights to the UK, as it’s purely a departure tax

- The UK APD doesn’t apply to people who are simply connecting in the UK for under 24 hours on a single ticket

- The UK APD doesn’t apply to children under the age of 16

Let me give some examples, and with each, I’ll explain whether or not the UK APD applies:

- Are you flying from London to Los Angeles? You’ll have to pay the long haul APD

- Are you flying from Los Angeles to London? You won’t have to pay the APD

- Are you flying from New York to London to Paris, and are connecting in London for under 24 hours? You won’t have to pay the APD

- Are you flying from Dubai to London to New York, and are connecting in London for under 24 hours? You won’t have to pay the APD

- Are you flying from London to Amsterdam to Los Angeles, with a connection of under 24 hours in Amsterdam? You’ll pay the long haul APD

- Are you flying from London to Amsterdam to Los Angeles, with a connection of over 24 hours in Amsterdam? You’ll pay the short haul APD

Hopefully, that covers most scenarios. As you can see, the APD is calculated based on the final destination of your ticket departing the UK, with continuous travel within 24 hours.

When do you pay the UK Air Passenger Duty?

The UK Air Passenger Duty is collected by airlines directly at the time of booking. So when you book a ticket that’s subjected to the APD, you can expect that your ticket price will include the APD. This isn’t something you have to pay at the airport, or after the fact, for example.

What’s the difference between the UK APD & fuel surcharges?

There’s often confusion about the distinction between the UK Air Passenger Duty and fuel surcharges, given that UK airlines are known for charging both, and it’s also why award tickets originating in the UK can cost so much. Just to clear that up:

- The UK APD is a government-imposed fee that can cost up to £180 on a one-way flight

- Fuel surcharges are imposed directly by airlines, and are a junk fee that has nothing to do with the government

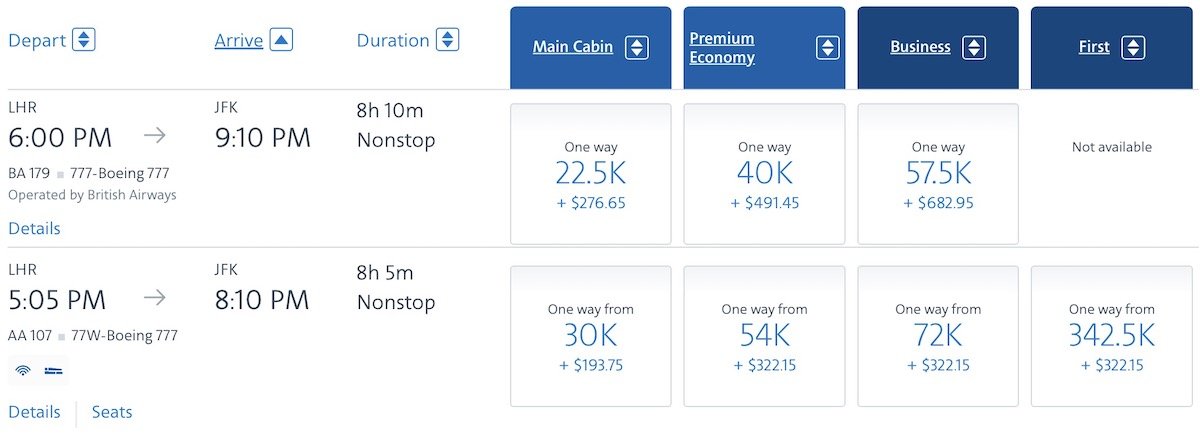

While only some airlines add fuel surcharges (like British Airways), all airlines have to charge their passengers originating in the UK the Air Passenger Duty. Just to give an example of that, say you’re redeeming American AAdvantage miles for business class travel between London and New York.

If you book for travel on American, there are no fuel surcharges, and you’d pay a total of $322.15, which accounts for the UK APD, as well as all the airport taxes and fees (which are on top of the UK APD). Meanwhile, if you were to book British Airways instead, there would be fuel surcharges, and you’d pay $682.95. As you can see, in this case, the fuel surcharges are $360.80.

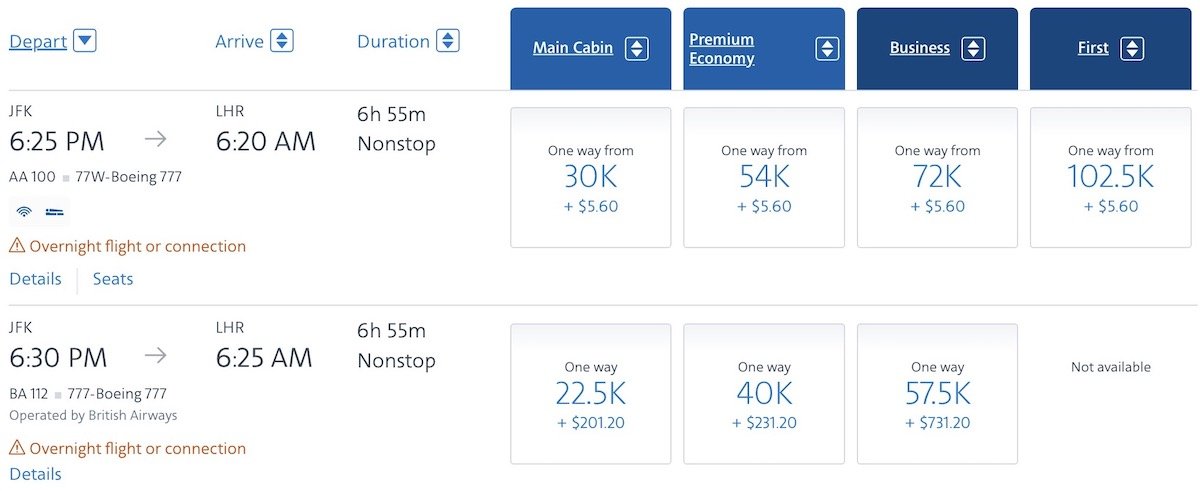

Since this often creates confusion, let’s look at flights in the other direction, from New York to London. If you were to book American, you’d pay just $5.60 in taxes and fees (there are no fuel surcharges or UK APD). Meanwhile, if you booked British Airways, you’d pay $731.20, meaning that the fuel surcharges are $725.60. Yes, fuel surcharges are higher originating in the US than the UK, but there’s still no UK APD here.

Hopefully, that clears up any confusion regarding the distinction between the UK APD and fuel surcharges.

Are there any ways to minimize the UK APD?

There’s no real way to “beat” the UK Air Passenger Duty, though there are some ways to minimize it, or at least be strategic about it. Different people will have different takes on the extent to which these strategies are worth it, but I figure they’re at least worth pointing out. Let me give a few examples.

Plan your stopover strategically

For example, say you’re redeeming British Airways Avios to fly roundtrip from New York to Paris via London, and you plan to have a stopover of more than 24 hours in London in one direction. If you’re going to do that, I’d highly recommend having your stopover in London on the outbound, rather than the return. Why? Because you’d only pay the short haul APD (£26), rather than the long haul APD (£191).

At the point in your itinerary where you’ve been in London for over 24 hours, you’ll be embarking on an itinerary of under 2,000 miles (to Paris), rather than an itinerary of over 2,000 miles (to New York).

Furthermore, if you want to visit London but only briefly, try to plan a stopover of just under 24 hours. That way you can avoid paying the UK APD altogether, all while still visiting the UK for a bit.

Mix economy & business class

When booking award tickets, some people like to travel one direction in business class and one direction in economy class, to splurge without redeeming too many miles. If you’re traveling to & from the UK and are using this strategy, ideally fly business class on your flight to the UK, and economy on your flight from the UK.

For one direction of travel, this would lower your APD from £191 to £87.

Fly out of Inverness

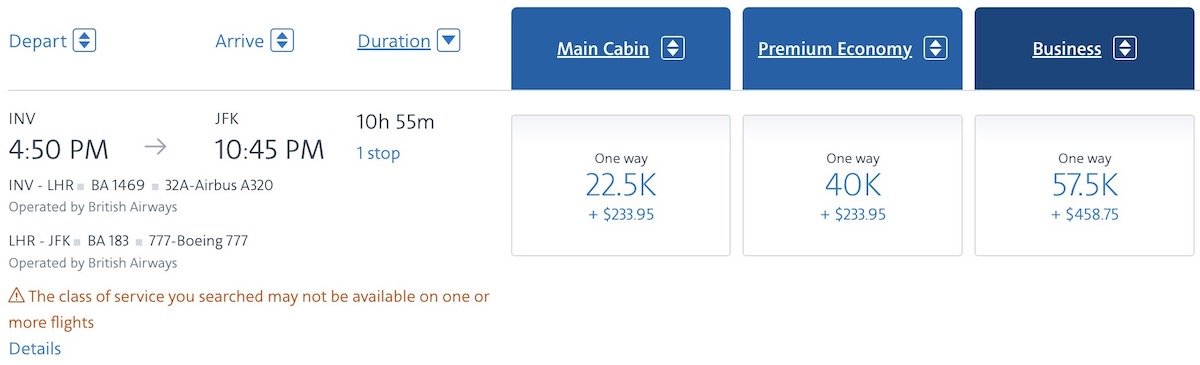

While Inverness is part of the United Kingdom, the Scottish Highlands and Islands are exempt from the UK APD. This is part of an agreement that dates back all the way to 1994, so it’s a nice little loophole. The catch is that not many people would naturally be starting there, and Inverness has fairly limited service.

For example, if you fly from Inverness to London to New York using American AAdvantage miles in business class, you’d pay $458.75, the vast majority of which is carrier imposed surcharges, as there’s no APD.

Meanwhile if you took just that same flight from London to New York, without originating in Inverness, you’d pay $682.95, which is due to being charged the UK APD.

Position yourself to another country

You can avoid the UK APD by flying out of a country other than the UK, and that could potentially save you quite a bit, especially on a business class ticket. There are a few ways to go about this:

- Some people will position themselves to Dublin to start their itinerary, because flights from Ireland aren’t subjected to the UK APD (and as a bonus, flights out of Ireland are often cheaper than flights out of the UK, even taking that out of the equation); in some cases flights between the UK and Ireland can cost under $20, so this could save you some significant money

- Some frequent flyer programs allow stopovers, so you can use those strategically; for example, Air Canada Aeroplan allows stopovers for 5,000 points one-way, so you could fly from London to Copenhagen to New York with a stopover of just over 24 hours in Copenhagen, and then you’d only have to pay the short haul APD rather than the long haul APD

Bottom line

The UK Air Passenger Duty is the world’s highest tax that’s levied on airline passengers. This applies to passengers with itineraries originating in the United Kingdom, and the tax ranges from £13 for an international short haul economy flight, to £200 for an international premium cabin long haul flight.

Hopefully the above provides a useful summary of how this works, and if anyone has any questions, please let me know. While the UK APD can’t be avoided altogether, there are most definitely ways to minimize it.

What has your experience been with the UK APD?

I travelled to Australia from UK economy class. I upgraded to business class for the return and have had to pay £600 tax. Is this correct?

I had to cancel a TUI flight from Luton to Lanzarote for March this year. ADP came to light because my travel insurance company Avanti deducted this from the settlement figure. TUI refused to refund claiming it is part of the cancellation cost, which was the whole price of two tickets.

Hi, my plan is to fly Chicago -London- Dublin... spend 10 days in Dublin, and then return Dublin,, ( have a 4-6 hour layover in London ), and then fly London -Chicago. Am i subject to the tax ,,, also,, i will be flying standby as a airline employee. Thank you in advance .

I’m confused. The UK Government site says the higher APD rate kicks in when the seat pitch is 40 inches or more. Air Canada’s premium economy is less than 40 inches. Your article says any premium seat incurs the higher tax. Which is correct?

Good tips. I tell my international friends when they visit Europe to do the UK first as and make sure their return is from the continent as they then only pay the APD to the continent (or nothing if taking the Eurostar) I absolutely hate the APD so my start cities are Milan, Barcelona and Copenhagen. (Though the latter are set to impose a small APD soon) Dublin and Shannon are interesting, especially to the USA with pre-clerance as a bonus for direct flights.

I'm flying from Dubai to Manchester on BA business class. However, BA have cancelled the Manchester flight, leaving me to get the train up north at my cost. They tell me the Manchester flight did not include an tax since that was due on my long haul flight only. I'm struggling to find if this is correct or not since the regulation do seem to be over complicated.

I’m flying to Lhr and taking a 10 day cruise all over Europe and returning to London. Will the tax apply to me if we fly directly home?

If the best connection through London I can get with BA makes my stopover 24 hrs and 35 mins and my inbound flight is delayed by 35 mins or more am I able to claim the fees back?

Agree with Sean M's comment about the fundamental error and that some airlines pass this on to consumers. I think the airlines that focus on the UK market that would have business anyway seem to pass them along. I also think if airlines absorb the fees more people would consider trips to the UK.

A ripoff.

I'm trying to piece together travel which would have me landing in London. I plan on spending some time in continental europe as well as London, but in the end I need to get back to NY in J using United miles. Gonna try to see if I can figure out a reasonably priced award that will get me to NY by skipping London or just connecting thru after I had visited earlier in the...

I'm trying to piece together travel which would have me landing in London. I plan on spending some time in continental europe as well as London, but in the end I need to get back to NY in J using United miles. Gonna try to see if I can figure out a reasonably priced award that will get me to NY by skipping London or just connecting thru after I had visited earlier in the trip. It is pretty messed up how high these fees get on people for long distance travel that simply can't use alternative travel means.

Thanks Ben. A truly useful article (as is your norm). And directly relevant to some booking decisions I'm trying to help a college friend make for one of her offspring to attend a Cubs-Cardinals game in LON. Particularly needed to know that the APD is same for Premium Y as for Business.

Be aware that you can't avoid the tax when transiting the UK using separate tickets. So if you redeem for award travel between LHR and SFO because you can't find availability out of CDG then purchase a paid or award ticket from CDG to LHR you still pay the tax.

It used to be you could apply for a refund if your transit time was under 24 hours but that is no longer the case as I learned when I attempted to do so.

Thanks for this Steve. I figured this was the case with separate tickets but it is nice to get confirmation.

Awesome article and very well written! I usually just position to Paris via Eurostar and fly from there. Didn't know about Inverness, that's great info. And jesus, BA has some real audacity with the YQ they charge. Absurd.

Is this why I get hit with a $100 "fee" if my upgrade out of LHR clears, even if I'm in transit? I stopped flying via LHR the second time it happened, years ago. Just last week I booked ADD - FRA - IAD. LHR was an option but I told the work travel agent no because I have plus points to burn. Security at LHR is a pain in the ass too. Too bad. I wouldn't mind it otherwise. UA has a nice lounge there.

Bookmarked.

Ben, thanks for this article.

Another option to avoid the APD is to take the train from London to continental Europe when you are ready to leave the UK. While you could then fly home immediately, it's better to enjoy a few days in Europe first. An open jaw ticket is perfect for this approach.

And pay £500 for a train journey and few days on the continent rather than the cheaper option of paying the ADP.

Split tickets is an option, although if there’s a problem the airline still isn’t liable for missed connections.

Perhaps I should have been clearer. My assumption is that you would want to visit other countries in addition to the UK during the trip. In that situation, you'll avoid the ADP by designing your itinerary to finish somewhere other than the UK.

How interesting. I always assumed the reason the DXB - LHR - SFO routes had significant fees was due to this tax. Now I learn that BA is just shady AF with some of their copays on awards. (It’s not transparent when booking via AA.)

But, if I fly LHR/ AMS/ JFK on two separate tickets using the same airline (KLM for example) , I would only pay the short haul tax?

Yes. However if LHR AMS is delayed they are not liable up rebook the onward free of charge or pay for accommodation in Amsterdam.

You're making a fundamental error here.

The APD is not a tax levied on passengers.

It is a tax levied on the air carrier for the priviledge of transporting passengers. As the name suggests, it was originally designed as a type of export duty on carriers transporting passengers, but has evolved since.

There is nothing that requires an airline to pass the APD costs onto the passengers. That is purely a commercial decision by...

You're making a fundamental error here.

The APD is not a tax levied on passengers.

It is a tax levied on the air carrier for the priviledge of transporting passengers. As the name suggests, it was originally designed as a type of export duty on carriers transporting passengers, but has evolved since.

There is nothing that requires an airline to pass the APD costs onto the passengers. That is purely a commercial decision by the airline, rather than a Government tax imposed on the passenger. Indeed, some airlines absorb these charges themselves on certain types of fares rather than charging the passenger.

Any make up greedy extortion would end up hurting the passengers anyway. Doesn't matter how you call it or structure it.

Heck even some leadership decision to (secretly) meddling in someone else's war far far away affected my gas prices.

The fundamental error is to assume that the vast overwhelming majority of airlines would NOT pass the cost onto passengers. A tiny amount of airlines absorb the cost, but that means nothing to Joe Bloggs. Gov't policy makers were aware of this right from the beginning. And they didn't care (as if they would!). As long as they got their money, that's all they were concerned about. For once, the airlines are not to blame...

The fundamental error is to assume that the vast overwhelming majority of airlines would NOT pass the cost onto passengers. A tiny amount of airlines absorb the cost, but that means nothing to Joe Bloggs. Gov't policy makers were aware of this right from the beginning. And they didn't care (as if they would!). As long as they got their money, that's all they were concerned about. For once, the airlines are not to blame for this extortionate impost. It's all on the government.

agh - it is a tax levied on passenger. Basic math - profit or loss = revenue - expenses. If your company expenses rise, your revenue needs to rise or you make a loss...then you go out of business....then there is less competition...then your prices rise.

Doesn't matter where the expenses are coming from, they are expenses. There is only one real source of revenue - your customers (outside of investments). Suck it up,...

agh - it is a tax levied on passenger. Basic math - profit or loss = revenue - expenses. If your company expenses rise, your revenue needs to rise or you make a loss...then you go out of business....then there is less competition...then your prices rise.

Doesn't matter where the expenses are coming from, they are expenses. There is only one real source of revenue - your customers (outside of investments). Suck it up, if the government levies taxes, the customer pays. It does not come from a hole in the ground (however popularist dreamland you may think).