I like to tell everyone who will listen about the huge value they can get by maximizing credit cards and using them responsibly. There are so many great credit cards out there, and those who are using debit cards or paying cash are basically throwing money out the window (assuming they’d be able to use credit cards responsibly, and not rely on credit card financing, other than a 0% intro APR offer).

When I’m talking to a skeptic about credit cards, there’s one misconception I hear more than any other — “but I heard that applying for credit cards is bad for your credit score.”

Is there any truth to that? At the moment I have nearly 30 credit cards, and my credit score is excellent. Let’s look at how that’s possible.

In this post:

How credit scores are calculated

Your credit score is made up of the following components:

- 35% of your score is your payment history (the percentage of payments you’ve made on-time)

- 30% of your score is your credit utilization (how much credit you’re using compared to your total limits)

- 15% of your score is your credit age (the average age of your open accounts)

- 10% of your score is the types of credit you use (how many different types of requests for credit you have)

- 10% of your score is your requests for new credit (how many times you’ve applied for credit)

Your takeaway here should be that if you make your payments on-time, don’t utilize too much of your credit, and keep your average account age fairly old, that’s 80% of your credit score right there.

How credit scores go down when applying for credit cards

When you apply for a new credit card there’s typically a hard pull to your credit profile. While the exact impact will vary by person, typically each inquiry will ding your score around two to three points. That will fall off your credit score within 24 months. Credit scores max out at 850, so a drop of a few points is typically quite insignificant. Sometimes the drop may be more, though it will generally recover pretty quickly.

But that’s the only consistent downside to applying for cards.

The other potential downside (though it doesn’t have to be a downside) is that your average age of accounts is part of your credit score. Let’s say you previously had just one credit card for 10 years, and you suddenly apply for a new card. Your average account age will go from 10 years to five years. The way to prevent this from being a problem is to keep a few credit cards open for a long time.

Ideally also hold onto the first credit cards you opened forever, even if you downgrade the card to a no annual fee product, because being able to maintain this credit history will be beneficial.

How credit scores go up when applying for credit cards

The above covers the limited downsides to applying for credit cards. An inquiry could lower your score temporarily. But you can see huge positive improvements to your credit score when you open new credit cards.

The most basic reason for this is that you’ll have a lot more available credit, and the percent of credit you utilize and your ability to make those payments on-time makes up 65% of your score.

For example, say you currently have one credit card with a $5,000 credit limit, and you spend $5,000 on it per month. You’re utilizing 100% of your credit.

To give an extreme example, say you then have 10 credit cards with a $5,000 credit line each, and you still spend $5,000 per month. You now have $50,000 of available credit, but you’re now only utilizing 10% of your credit.

This will have a hugely positive impact on your credit score. Why? Because it raises a red flag when you’re using almost all of your credit.

If you’re using all the credit that you have available, issuers wonder what will happen if they extend you more credit. Meanwhile if you have a lot of credit that you’re using responsibly, card issuers view that as low risk, because they can see how responsible you are.

A real life credit score example

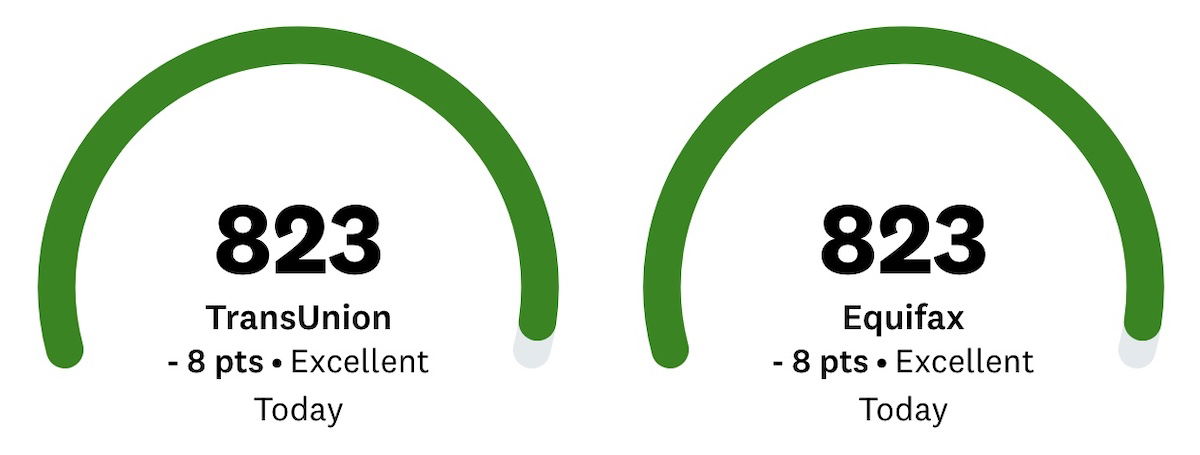

I have nearly 30 credit cards, so let’s take a look at my actual credit score and details. On a scale of 300 to 850, my credit score is 823 with both Transunion and Equifax. That’s excellent.

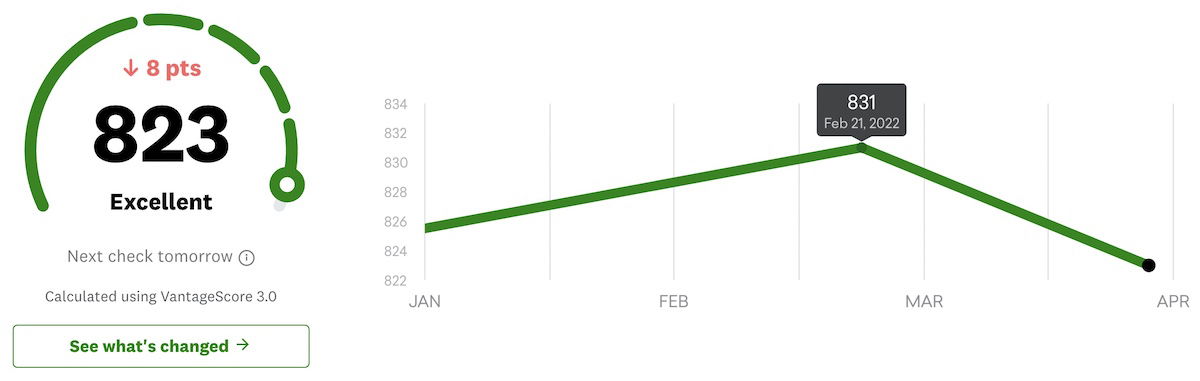

My score has recently dropped by eight points. It was 831 in February, and the slight drop reflects that I’ve had a few hard credit inquiries in recent weeks. As you can see, the impact hasn’t been too significant.

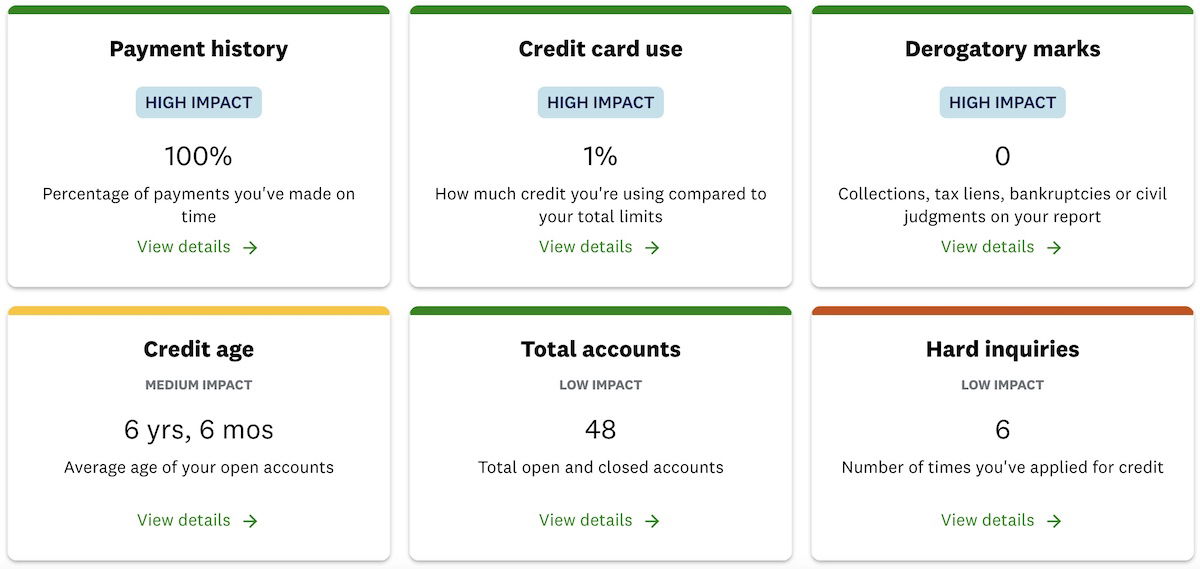

Below is a more detailed description of what comprises my score.

In the high impact areas I do very well — I have very low credit utilization (1% — that’s how much available credit I have), I make 100% of my payments on-time, and I have zero derogatory marks. Those are the most important things on your credit report, and my credit utilization wouldn’t be so low if I didn’t have so many cards.

Furthermore, my average age of accounts is even quite good thanks to the cards I’ve had open long term, which always help keep that number up. Even though the six hard inquiries on my record aren’t ideal, my credit score is still excellent, which shows how you can apply for cards but still have a great credit score.

To be clear, my situation isn’t an isolated incident. I get emails all the time from people who have scores in the low 700s and are confused, because they point out that they have one credit card and use it responsibly.

They’re worried their score will go down if they apply for more cards, but in almost all cases their scores go up in the long run when they get more cards and use them responsibly.

Why you might want a lot of credit cards

The logical follow-up question is “okay, you can have a lot of credit cards, but why would you want to?”

Well, first and foremost my goal is for those of you who are exclusively using debit cards to instead switch to credit cards, assuming you can use your credit responsibly (it’s almost never worth carrying a balance on a credit card).

Way too many people only have debit cards, so it’s time to start building your credit and realize that applying for credit cards can potentially help your score, rather than hurt it. Pick up a card like the Chase Sapphire Preferred® Card (review) or Chase Sapphire Reserve® Card (review), which offer easy to use points and great bonuses on spending.

If you don’t want to get into points, pick up something like the Citi Double Cash® Card (review), which has no annual fee and offers 1% back when you make a purchase, and 1% back when you pay for that purchase (in the form of ThankYou points). These rewards can even be combined with ThankYou points earned on other cards, like the Citi Premier® Card (review), to get even more value.

But why would you want to have many credit cards?

- First you want some cards that can help you maximize the points you earn for your everyday spending — the American Express® Green Card (review) offers 3x points on dining and travel, and the American Express® Gold Card (review) offers 4x points at restaurants, 4x points on US supermarkets (up to $25,000 annually), and 3x points on airfare purchased directly with airlines, just to give a couple of examples

- Then there are some credit cards that offer annual perks that more than justify the annual fee — the World of Hyatt Credit Card (review) and IHG One Rewards Premier Credit Card (review) each offer valuable anniversary free night certificates just for paying the annual fee, with no spending requirements

- Then to help build your credit score long term and keep your average age of accounts as high as possible, it can make sense to have some no annual fee cards, like the Chase Freedom FlexSM (review) and Chase Freedom Unlimited® (review)

The information and associated card details on this page for the American Express Green Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

Bottom line

There are a lot of misconceptions about credit cards, though probably the most common involves the belief that applying for credit cards will hurt your credit score. This simply isn’t the case, at least if you use them correctly and take a long term approach to credit cards.

In the short term you will be dinged a few points if you apply for a credit card, though the long term benefits more than outweigh that, including your decreased credit utilization and positive payment history.

To maintain a great credit score, I highly recommend:

- Keeping your oldest cards open, even if you don’t use them much, and even if you downgrade them to a no annual fee product

- Always paying your credit card bill on-time (ideally early)

- Keeping your credit utilization low, and you can do this by paying off your bill before your credit card statement even closes, since the balance on the closing date is how utilization is calculated

Hopefully this inspires at least a few of you with debit cards or limited credit cards to start maximizing your points!

Hi, my son is a college student without any income; he has my additional cards for a few years, his credit score is around 774 out of 850 for Experian. He is planning to apply his own first credit card now.

He flies international (CX or UA or Qatar) two times a year, and sometime stays in Marriott , dine in restaurants and do some online purchase.

Which credit card would you recommend him to apply for his first card and wont get rejected for sure? Please advise.

Being a dual citizen the major difference in Australia is that the larger your credit limit the greater your possible “debt”

The part that you are missing is that your score will drop if you use one card and it bills with +30% on that card. For example, you have a number of cards with a total available credit line of 100K across all cards and they all have a zero balance. One of your cards has a $500.00 credit limit and you charge $350.00 and it bills on your statement. Your credit score will drop...

The part that you are missing is that your score will drop if you use one card and it bills with +30% on that card. For example, you have a number of cards with a total available credit line of 100K across all cards and they all have a zero balance. One of your cards has a $500.00 credit limit and you charge $350.00 and it bills on your statement. Your credit score will drop by 30-40 points because you have used of 30% ON ONE CARD. Completely stupid scoring system, but that's how it works. I tested this in 2021 a couple of times. As soon as I paid the $350 off, score jumped back up.

My credit score ranges between 798-817 overtime with different agencies , but always always the score dings 4points down when I apply for a new card .

As long as you pay your bill in full before the due date then it is no problem. There is no need to pay the bill early or before the statement closes. If this was a higher interest rate market you would be doing yourself a disservice. You would be spending the money early for no reason. This would impact your credit score but not as much as you think.

The one reason I can think of paying off a credit card early is managing spending with smaller credit limits

It depends on your credit usage. If you spend a lot on credit cards for the purposes of points, then it makes sense to pay the credit card prior to the statement closing date. For instance, if I charge $15K to my credit card because it is convenient, and I want a threshold bonus, then if I pay the card prior to the monthly closing date, my credit usage will be zero. If I wait...

It depends on your credit usage. If you spend a lot on credit cards for the purposes of points, then it makes sense to pay the credit card prior to the statement closing date. For instance, if I charge $15K to my credit card because it is convenient, and I want a threshold bonus, then if I pay the card prior to the monthly closing date, my credit usage will be zero. If I wait for the statement to pay, then the $15,000 will show on a credit report as balance owed on a credit card. By simply paying it online a day earlier than the statement date, your credit score will be higher. If the money is sitting in a low interest bank account, it makes sense just to pay the balance prior to the closing date. This is especially true if you are charging a lot each month across several credit cards, which some of us who read travel point blogs tend to do.

Nice, Enjoy Europe