Link: Apply now for the United℠ Explorer Card

Chase and United offer a suite of co-branded credit cards, and in this post, I wanted to take a closer look at the United℠ Explorer Card. I’d argue that this is one of the most lucrative airline credit cards with an annual fee of under $100.

In this post:

United Airlines Explorer Card Basics For March 2024

The United Explorer Card is probably Chase’s most popular co-branded United Airlines credit card. This is a consumer card that offers perks that can be valuable whether you’re a frequent United flyer or just travel with the airline every once in a while.

Let’s look at what you need to know about this card, from the welcome bonus to the return on spending the card offers to the perks.

Welcome Bonus Of 50,000 MileagePlus Miles

The United Explorer Card is offering a limited-time welcome bonus of 50,000 bonus MileagePlus miles after spending $3,000 within the first three months. I value United miles at ~1.1 cents each, so to me the bonus miles are worth $550.

Card Eligibility & Restrictions

The welcome bonus on the United Explorer Card isn’t available to those who currently have the card, or those who have received a new cardmember bonus on the card in the past 24 months. However, you are eligible for this card if you have (or have had) another United Airlines credit card.

In addition to that, there are general restrictions when applying for Chase cards, including the 5/24 rule (though that’s not consistently enforced anymore).

$95 Annual Fee, Waived The First Year

The United Explorer Card has a $0 introductory annual fee for the first year, then $95. This is a great way to try the card before paying an annual fee.

You can add authorized users to the card at no extra cost.

Earn 2x Miles On Restaurants, Hotels, And United Flights

The United Explorer Card offers bonus categories that some might find useful. Here’s the rewards structure of the card:

- Earn 2x miles on United purchases

- Earn 2x miles at restaurants

- Earn 2x miles at hotels

- Earn 1x miles on all other purchases

For an airline credit card, those are some extremely well-rounded bonus categories. However, I’d argue there are still better cards for everyday spending.

No Foreign Transaction Fees

The United Airlines Explorer Card has no foreign transaction fees, so this is a good card for purchases abroad. Visa has excellent global acceptance, and you may earn bonus miles for purchases abroad, including at restaurants and hotels.

Earn MileagePlus PQPs Toward Status

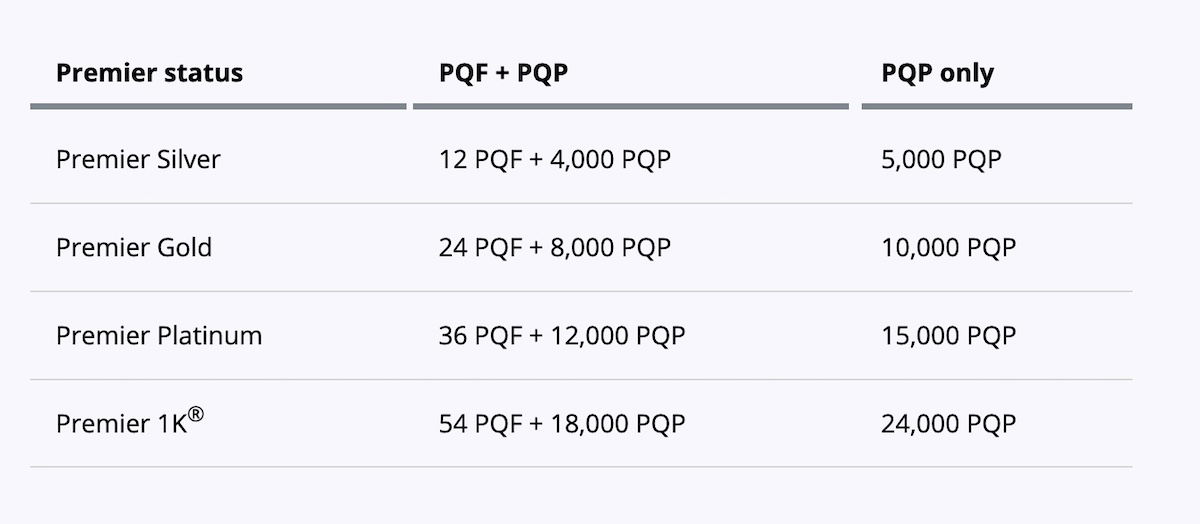

Spending money on the United Explorer Card can help you earn MileagePlus status. The card offers 25 PQPs for every $500 spent on purchases, up to a maximum of 1,000 PQPs per year. The primary reason you should consider spending money on the card is if you want to earn PQPs. As a reminder, below are the MileagePlus elite requirements for 2024.

United Explorer Card Perks & Benefits

The United Explorer Card offers an excellent welcome bonus and an annual fee that’s waived for the first year, but the card also has all kinds of fantastic perks. I’d argue that the United Explorer Card is the most perks-rich airline credit card with an annual fee of under $100. In no particular order, let’s look at what you can expect…

A Free First Checked Bag

The United Explorer Card primary cardmember and one companion traveling on the same reservation receive a standard free first checked bag. You must pay for your ticket with your United Airlines credit card to qualify for this benefit.

United charges $35 for a first checked bag, so this is a value of up to $140 on a roundtrip ticket.

Two United Club Passes Annually

You receive two United Club passes annually for having the United Explorer Card. This includes the year you open your card, and any subsequent years. These will automatically be deposited into your MileagePlus account within four weeks.

A United Club pass ordinarily costs $59, so that’s a value of up to $118. This is an awesome perk for the occasional traveler since it can make your travels on United more pleasant.

25% Back On United Inflight Purchases

If you have the United Explorer Card you’ll receive 25% back in the form of an account statement credit on purchases of food, beverages, and Wi-Fi, onboard United and United Express flights.

You have to pay with your United Explorer Card, and your statement credit should post within 24 hours.

Global Entry, TSA PreCheck, Or NEXUS Credit

The United Explorer Card offers a Global Entry, TSA PreCheck, or NEXUS credit every four years. Simply charge the enrollment fee of up to $100 to your card, and it will automatically be reimbursed.

Nowadays, quite a few credit cards offer these fee credits, so you can always use this benefit for a friend or family member. Simply use your credit card to pay, and you’ll automatically receive the statement credit.

Priority Boarding

For having the United Explorer Card, you and your companions receive priority boarding on United and United Express flights. You can board before general boarding, after customers with Premier Access, and those requiring special assistance. This would be in Group 2.

Premier Upgrades On Award Tickets

MileagePlus elite members receive complimentary upgrades on domestic and short-haul international flights (in most markets) when paying cash for their tickets. If you have the Explorer Card, you also receive Premier upgrades on award tickets when traveling on United or United Express. Travel companions and authorized users aren’t eligible for this benefit.

Expanded Award Availability

For having the United Explorer Card, you receive access to more award availability. This includes both extra saver and standard level award availability. It can be useful because MileagePlus miles are often best used for travel on United metal.

Primary Rental Car CDW

The United Explorer Card offers a primary collision damage waiver benefit. Just decline the rental company’s collision insurance and charge the entire rental cost to your card. This is a really valuable benefit that comes in handy when renting cars.

Trip Delay & Lost Luggage Protection

The United Explorer Card offers a variety of protection benefits when traveling, assuming you pay for purchases with your card. These features include the following:

- Trip cancellation & trip interruption insurance — be reimbursed up to $1,500 per person and $6,000 per trip when your trip is canceled or cut short due to sickness, severe weather, etc.

- Trip delay reimbursement — if your flight is delayed by more than 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket

- Lost luggage reimbursement — be reimbursed up to $3,000 per passenger if you or your immediate family member check or carry on luggage that is damaged or lost by an airline

- Baggage delay insurance — be reimbursed up to $100 per day for three days for essential purchases when your bag is delayed by over six hours

Make sure you check your cardmember agreement for all of the details, since there are terms & conditions.

Is The United Explorer Card Worth It?

While I generally wouldn’t recommend using the United Explorer Card for your everyday spending (since there are better cards for earning United miles), this is one of the best airline credit cards when it comes to having great perks and a reasonable annual fee. On the surface, I consider this to be the sub-$100 airline credit card with the strongest perks.

If you’re a United Airlines elite member you may benefit from the United Club passes, additional award availability, 25% savings on inflight purchases, Global Entry or TSA PreCheck credit, expanded award availability, upgrades on award tickets, and more.

If you’re a non-elite member, then the first checked bag free, priority boarding, United Club passes, savings on inflight purchases, and more, could come in handy.

This is a particularly good time to pick up this card, given the current bonus.

United Explorer Card Vs. United Quest Card

The United Quest℠ Card has a $250 annual fee, so it’s a more premium version of the United Explorer Card. I’d say this is an excellent card:

- The United Quest Card is offering a welcome bonus of 60,000 MileagePlus miles + 500 PQP after spending $4,000 within three months

- The United Quest Card offers some unique perks, like a $125 annual United credit, plus up to 10,000 miles reimbursed each year when redeeming miles on United; for many, those two perks alone will more than offset the annual fee

Read a full review of the United Quest Card.

United Explorer Card Vs. United Club Infinite Card

In addition to the United Explorer Card, there’s also the United Club℠ Infinite Card, which is United Airlines’ most premium personal credit card. The United Club Infinite Card has a $525 annual fee, but offers some fantastic incremental perks, including the following:

- The United Club Infinite Card is offering a welcome bonus of 80,000 MileagePlus miles after spending $5,000 within three months

- A United Club membership for as long as you have the card

- A first and second checked bag free for you and one companion when flying United

- Premier Access travel services, including priority check-in, security, boarding, and baggage handling

If you’re a frequent United flyer and value United Club access, then I think this card could be worth it.

Read a full review of the United Club Infinite Card.

United Explorer Card Vs. United Business Card

The United℠ Business Card is essentially the business version of the United Explorer Card, so if you’re looking for a small business card, that’s what I would consider.

The card offers many similar benefits to the United Explorer Card, including a first checked bag free, priority boarding, 25% savings on inflight purchases, and more. The card even has some unique perks, like an anniversary bonus of 5,000 miles if you have the card in conjunction with a personal United card.

Read a full review of the United Business Card.

The Best Way To Earn United Miles With Credit Cards

While the United Explorer Card has great perks, I wouldn’t generally use it for my everyday spending. That’s true whether you want to earn United miles for your spending or not. United MileagePlus is a Chase Ultimate Rewards transfer partner, so you can convert Ultimate Rewards points into United miles at a 1:1 ratio.

There are so many great Ultimate Rewards cards that earn points at a potentially faster rate than you’d earn directly through United, so that’s something worth considering.

Bottom Line

The United Explorer Card is one of the most benefits-rich airline credit cards out there. For a low $95 annual fee (which is even waived for the first year) you get two United Club passes annually, savings on inflight purchases, a Global Entry or TSA PreCheck credit, a first checked bag free, and much more.

If you want to learn more about the United Explorer Card or apply, follow this link.

I just applied and the application is "in review".

I don't know how long that lasts, sp

So I applied for a BofA credit card and was instantly approved.

I have this card and it is particularly great if you fly United. Just the savings in baggage mostly covers the annual $95 fee, which is deferred for 1 year, plus the 2 annual free lounge passes (free drinks and food). Not to mention the high signup bonus points. I have this card and also the Chase Sapphire Preferred (just cashed in my $600.00 statement credit related to my signup bonus (you do have to...

I have this card and it is particularly great if you fly United. Just the savings in baggage mostly covers the annual $95 fee, which is deferred for 1 year, plus the 2 annual free lounge passes (free drinks and food). Not to mention the high signup bonus points. I have this card and also the Chase Sapphire Preferred (just cashed in my $600.00 statement credit related to my signup bonus (you do have to spend $4K in 3 months to get it, relatively easy in today's economy.